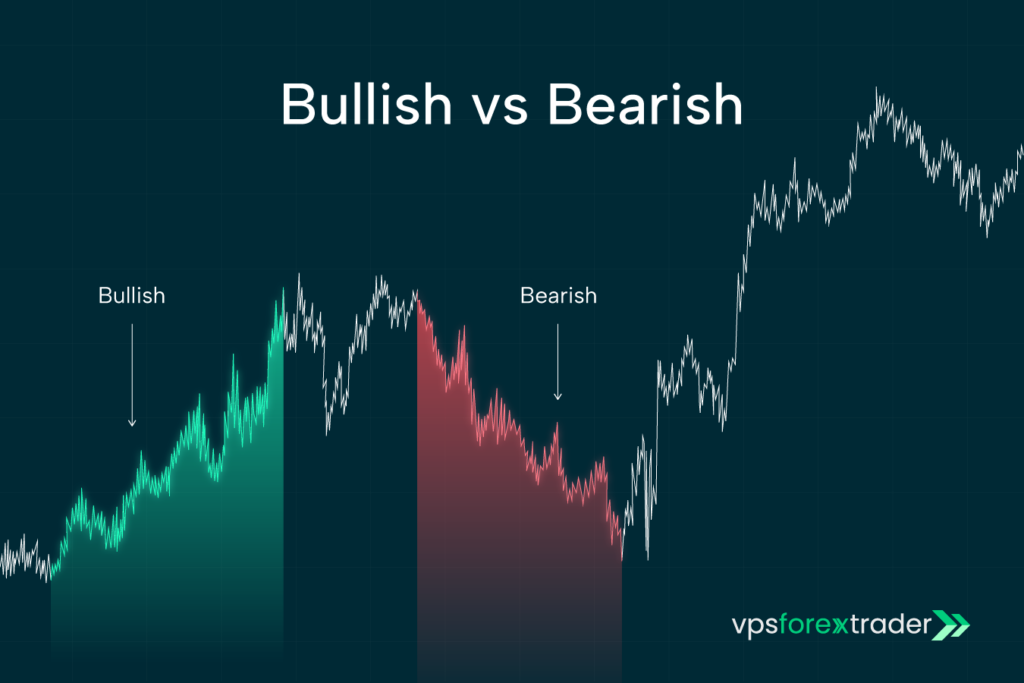

Financial markets are driven by sentiments. These can be positive or negative sentiments, giving rise to the concept of bullish and bearish markets. These terms define the overall expectations of investors and they drive both short-term price movements and long-term trends in the financial market.

In this post we will define what is bullish and bearish, highlighting the differences between these two market sentiments. We’ll also do a detailed bullish vs bearish comparison to understand the key differences between them.

What is a Bull Market? Explained

Before diving into a comparison between bull market vs bear market, let’s begin by defining some terms beginning with a bullish meaning. What is a bullish market and how is it different from a bearish market?

A bull market or bullish market refers to market conditions characterized by rising prices and generally favorable conditions. This market condition leads to a positive or optimistic outlook where investors expect the price of assets to rise. In a bullish market, investors can earn profit by buying and holding assets or taking long positions.

Understanding Bearish Trends in the Market

Next, to further understand the difference between bear vs bull market, let’s explore bearish meaning. A market is described as bearish when it is in decline. This is characterized by a continuous drop in asset prices, leading to a pessimistic outlook for investors. In a bearish market, investors sell assets or take defensive positions instead of buying.

Bull vs Bear Market: Key Differences

When you take a closer look at a bear vs bull market, the key difference as you will discover is in their price trend. Knowing what is the difference between a bull and a bear market will also influence your investment strategy and behavior. Here are some of the key differences between these two market conditions:

- Price trend: as explained above, prices are on the rise in the bull market. On the flip side, prices are in a declining trend in the bear market.

- Demand and supply: the bull market is characterized by a combination of strong demand and weak supply of securities. This means many investors are interested in buying, while only a few are willing to sell, resulting in a price rise as investors compete to obtain assets. The opposite happens in a bearish market. Investors are pessimistic, which means more people will be looking to sell, while only a few are interested in buying, causing prices to drop.

- Investment strategy: in a bullish market, the best strategy is to simply focus on growth stocks and long-term investment options. On the other hand, investors in a bear market tend to focus on defensive stocks and short-term trading strategies, optimized with a reliable Forex VPS for 24/7 execution, since bearish market conditions are often short-lived.

What Does Bullish Mean in Stock Market Investments?

So what does bullish mean from a stock market investment perspective? In stock market investments, a bullish outlook means prices of stocks are expected to rise over a certain period of time. This bullish market meaning can be applied to specific market indexes, an industry, individual stocks, or an entire asset class depending on the context of the conversation.

To help investors fully understand what does bullish mean in stocks, it is typically defined as a market condition where the prices of stocks rise by up to 20% or more after a recent low.

How to Identify Bullish and Bearish Market Trends

Now that you are familiar with bullish vs bearish meaning, how do you identify each of them? Generally, bullish and bearish markets have unique indicators that investors can use to identify them when studying market trends.

On financial market charts, a bullish market shows an uptrend in the price of the stock or index being considered. This is characterized by the price making higher highs and higher lows. On the flip side, bearish markets show lower highs and lower lows, indicating that the price is in a downtrend.

Investors can also use technical indicators such as moving averages and relative strength index to identify potential market trends. Analyzing trading volumes and chart patterns can also help you identify trends and potential reversals in a bullish vs bearish market.

Bullish vs Bearish: Impact on Stock Market Strategy

Expectedly there are different investing strategies for bull and bear markets. So how do you trade bearish vs bullish stock? First, you need to know the difference between bull vs bear markets and their impact on trading strategy.

The basic strategy in bullish markets is to buy low and sell high. Thus, it is best to target currency pairs with strong upward momentum and good economic indicators. Confirm the uptrend by using technical analysis tools such as moving averages and trendless. Then you can look for the right moment and enter long positions as you ride the upward wave. Don’t forget to protect your gains from unexpected market reversals by setting stop-loss orders.

When the market is bearish, investors naturally adopt a defensive strategy. The trick is to sell or short-sell currency pairs in order to profit from the downward price movements. Note that the chances of ending up with a loss is greater in bearish markets because stock prices are continually falling. While some investors buy instead of selling in anticipation of an upturn, this is a long-term strategy and you may take some losses before any turnaround occurs.

Distinction Between Market Types and Timeframes

When people describe a market as bullish or bearish, they’re not always talking about the same thing. Sometimes, they’re referring to long-term trends that last for years, while other times, they mean short-term trading sentiment that can shift in hours or even minutes.

Understanding the type of market and the timeframe you’re analyzing is critical for traders and investors alike – the same price move can mean very different things depending on context.

1. Bullish vs Bearish Sentiment vs Market Trends

Before diving into timeframes, it’s important to distinguish between market sentiment and market type:

| Term | Meaning | Duration | Trader Example |

|---|---|---|---|

| Bullish Sentiment | Expecting price increases; confident buyers dominate | Hours → Weeks | “I’m bullish on EUR/USD after this breakout.” |

| Bearish Sentiment | Expecting price declines; sellers control the market | Hours → Weeks | “I’m bearish on Tesla after weak earnings.” |

| Bull Market | Sustained uptrend; broader optimism and economic expansion | Months → Years | Stocks gaining steadily after 2020 pandemic lows |

| Bear Market | Sustained downtrend; widespread selling and recession fears | Months → Years | 2008 financial crisis market collapse |

Key Difference:

- Sentiment = short-term trader outlook.

- Market Type = structural trend over longer periods.

2. Understanding Market Timeframes

a) Short-Term Trading (Intraday → Weeks)

- Who focuses here: Day traders, scalpers, and swing traders.

- Bullish or bearish sentiment can flip multiple times in a single day based on news, technical setups, or data releases.

- Example: EUR/USD might rally 60 pips during NFP but reverse within hours if wage data surprises traders.

Takeaway: Short-term traders rely on technical indicators, news catalysts, and volatility analysis rather than macroeconomic trends.

b) Medium-Term Market Cycles (Weeks → Months)

- Who focuses here: Swing traders and position traders.

- In this timeframe, bullish or bearish bias lasts longer but still reacts strongly to earnings seasons, interest rate changes, or geopolitical events.

- Example: A 3-month bullish uptrend in NASDAQ can pause or reverse entirely after the Federal Reserve signals a hawkish policy shift.

Takeaway: Combining technical levels with fundamental triggers is key at this horizon.

c) Long-Term Market Phases (Years → Decades)

- Who focuses here: Investors, retirement planners, and fund managers.

- Bull and bear markets are defined at this level, typically lasting years:

- Bull Market: Sustained gains, usually marked by 20%+ rises from recent lows.

- Bear Market: Prolonged declines of 20% or more from recent highs.

- Example:

- The 2009–2020 period was one of the longest bull markets in U.S. history, fueled by low interest rates and strong corporate earnings.

- The 2008 Global Financial Crisis marked a steep, sustained bear market.

Takeaway: For long-term strategies, economic cycles, central bank policy, and corporate growth dominate – short-term volatility matters far less.

3. Why Timeframes Matter for Traders

A trader can feel bullish while the overall market is bearish – and both can be correct.

Example Scenario:

- The S&P 500 is in a long-term bear market after dropping 25% from its peak.

- But on a 4-hour chart, the index shows a bullish breakout due to short-term earnings beats.

- A day trader might go long for a quick trade, while an investor continues hedging against further declines.

Key Lesson: Always define your timeframe before forming a bullish or bearish bias.

4. Practical Trading Tips

- Don’t confuse sentiment with structure – a bullish day doesn’t mean the start of a bull market.

- Align your strategy with your time horizon:

- Scalpers/Day Traders: Focus on intraday sentiment shifts.

- Swing Traders: Balance technical setups with macro drivers.

- Investors: Focus on business cycles, earnings, and central bank policies.

- Always confirm your analysis across multiple timeframes to avoid trading against the dominant trend.

Investor Psychology & Common Biases

Markets are not driven by numbers alone – they’re also powered by human emotions, cognitive biases, and herd behavior. Whether the market is bullish or bearish, understanding how psychology shapes decision-making can give traders an edge in anticipating sentiment shifts and avoiding costly mistakes.

1. The Emotional Drivers Behind Bullish & Bearish Phases

Investor psychology tends to follow cycles that repeat across decades. Knowing these patterns helps traders recognize where markets stand within broader phases.

| Market Phase | Dominant Emotion | Investor Behavior | Impact on Markets |

|---|---|---|---|

| Bullish Optimism | Confidence & FOMO | Investors buy aggressively, expecting prices to keep rising | Asset prices trend higher |

| Euphoria Peak | Overconfidence | Traders overleverage, believing “this time is different” | Market tops form |

| Bearish Fear | Panic & Capitulation | Investors sell at a loss, avoiding risk entirely | Sharp price declines |

| Despair Bottom | Hopelessness | Selling exhausts; little buying interest | Prices stabilize |

| Recovery | Cautious Optimism | Confidence slowly rebuilds | Trend reversals begin |

This emotional cycle explains why bullish peaks often lead to overvaluation and bearish bottoms often lead to undervaluation.

2. Common Investor Biases During Bull & Bear Markets

Psychological biases influence how traders interpret information, make decisions, and react to volatility. Here are the most common ones:

a) Overconfidence Bias (Bull Markets)

- Investors overestimate their knowledge and believe they can’t lose.

- Leads to excessive risk-taking, overleveraging, and ignoring warning signals.

- Example: During the dot-com bubble (1998–2000), traders piled into tech stocks expecting infinite growth – many faced massive losses when the bubble burst.

b) Loss Aversion Bias (Bear Markets)

- Investors fear losing money more than they value potential gains.

- This drives panic selling at market bottoms, locking in losses instead of waiting for reversals.

- Example: In the 2008 financial crisis, many retail traders sold equities at deep losses – only to miss the historic 2009–2020 bull market rally.

c) Herd Mentality & FOMO

- Traders follow the crowd, buying when everyone’s bullish and selling when panic sets in.

- This behavior amplifies volatility, pushing prices higher in bull runs and lower in sell-offs.

- Example: During the 2021 crypto rally, Bitcoin soared partly due to mass FOMO buying – then collapsed when sentiment shifted.

d) Confirmation Bias

- Investors seek out information that supports their existing bullish or bearish views, ignoring contradictory data.

- This can lead to holding onto losing positions far too long or entering trends too late.

e) Recency Bias

- Traders assume recent performance will continue, ignoring long-term historical patterns.

- In bull markets, they believe “stocks only go up.” In bear markets, they assume “things will keep getting worse.”

3. Contrarian Strategies: Profiting from Sentiment Extremes

Successful traders often look for psychology-driven extremes to identify potential turning points:

- In Bull Markets: When euphoria and FOMO dominate, risk of a market top increases. Contrarians begin taking profits while others pile in.

- In Bear Markets: When panic selling reaches extremes and valuations collapse, contrarians accumulate undervalued assets while others exit.

Example:

During March 2020, when fear over COVID-19 peaked, markets briefly crashed – but contrarian traders who bought into panic captured massive gains during the record-breaking rebound.

Practical Tips to Manage Emotional Biases

| Bias / Emotion | Common Mistake | Counter Strategy |

|---|---|---|

| Overconfidence | Overleveraging in bull runs | Use position sizing and stop-losses |

| Loss Aversion | Selling at market bottoms | Focus on long-term trends & diversify |

| Herd Mentality | Following FOMO trades | Validate setups with independent analysis |

| Confirmation Bias | Ignoring contrary data | Use objective indicators and risk models |

| Recency Bias | Assuming current trend continues forever | Review historical cycles before trading |

Historical Examples of Bull and Bear Markets

Understanding the difference between bullish and bearish markets becomes clearer when looking at real historical examples. Over the decades, financial markets have experienced prolonged rallies and sharp downturns driven by economic cycles, policy changes, investor psychology, and external shocks.

Studying these moments helps traders recognize patterns, risk factors, and opportunities that repeat across time.

1. The Dot-Com Bubble (1995 – 2000) – Bullish Euphoria, Then Collapse

- Phase: Bull Market → Bear Market

- What Happened:

- The mid-to-late 1990s saw explosive growth in internet-related stocks, with tech companies attracting huge valuations despite little or no profits.

- Fueled by FOMO, investors poured into equities, driving the NASDAQ up nearly 400% between 1995 and March 2000.

- Turning Point:

- When the bubble burst, the NASDAQ lost ~78% of its value between 2000 and 2002.

- Key Lesson for Traders:

- Bullish sentiment can quickly inflate bubbles, but fundamentals eventually catch up.

- Extreme euphoria often signals the end of a bull run, not its continuation.

2. The 2008 Global Financial Crisis – A Bear Market Triggered by Leverage

- Phase: Bear Market

- What Happened:

- Years of rising housing prices and aggressive lending led to a credit bubble.

- When mortgage-backed securities began collapsing, major banks failed, triggering a global financial crisis.

- From October 2007 to March 2009, the S&P 500 plunged ~57%.

- Market Sentiment:

- Widespread panic, extreme risk aversion, and institutional deleveraging.

- Aftermath:

- The crisis led to unprecedented central bank stimulus and ultra-low interest rates, which eventually fueled the next record-breaking bull market.

- Key Lesson for Traders:

- Overconfidence during prolonged bull markets often hides systemic risks.

- Bear markets can be brutal but also create opportunities for massive rebounds.

3. The Longest Bull Market in U.S. History (2009 – 2020)

- Phase: Bull Market

- What Happened:

- Following the 2008 crash, coordinated central bank intervention, quantitative easing, and ultra-low interest rates sparked a historic rally.

- From March 2009 to February 2020, the S&P 500 gained over 400%.

- Investor Psychology:

- At first, traders doubted the rally (“bear market disbelief phase”), but growing confidence evolved into optimism and euphoria by 2018–2019.

- Key Lesson for Traders:

- Monetary policy plays a critical role in sustaining bull markets.

- However, prolonged rallies can cause traders to underestimate risks – until external shocks hit.

4. COVID-19 Crash & Recovery (2020) – From Panic to Record Highs

- Phase: Bear Market → Bull Market

- What Happened:

- In early 2020, global lockdowns triggered a rapid market crash – the S&P 500 fell ~34% in just one month (Feb–Mar 2020).

- Central banks and governments launched massive stimulus programs, sparking one of the fastest recoveries in history.

- By August 2020, the market had fully recovered its losses, and indices pushed to new all-time highs.

- Key Lesson for Traders:

- Bear markets can unfold extremely quickly – timing and risk management are critical.

- Ultra-dovish policies and liquidity injections can reverse bearish sentiment rapidly.

5. 2022 Inflation-Driven Bear Market

- Phase: Bear Market

- What Happened:

- After years of easy monetary policy, global inflation surged to multi-decade highs due to supply chain disruptions, energy shocks, and pandemic-era stimulus.

- The U.S. Federal Reserve and other central banks responded with aggressive rate hikes, sending markets lower.

- The S&P 500 fell ~25% between January and October 2022.

- Market Psychology:

- A shift from euphoria in 2021 (crypto booms, meme stock rallies) to fear and defensive positioning.

- Key Lesson for Traders:

- Macroeconomic forces like inflation and monetary policy changes can flip a bull market into a bear market faster than expected.

- Watching central bank signals is essential when trading longer-term cycles.

6. Key Insights Across Bull & Bear Markets

| Period | Market Phase | Peak-to-Trough Move | Main Driver | Trader Lesson |

|---|---|---|---|---|

| 1995–2000 | Bull → Bear | +400% → −78% (NASDAQ) | Dot-com bubble, tech overvaluation | Euphoria leads to bubbles, then sharp collapses |

| 2007–2009 | Bear | −57% (S&P 500) | Housing crisis & leverage risks | Overconfidence can mask systemic threats |

| 2009–2020 | Bull | +400% (S&P 500) | QE + low rates, earnings growth | Central bank policy sustains prolonged rallies |

| 2020 Crash & Rebound | Bear → Bull | −34% → +100%+ recovery | COVID shock + massive stimulus | Panic bottoms can create explosive upside |

| 2022 Bear Market | Bear | −25% (S&P 500) | Inflation + rate hikes | Watch macro forces driving sentiment shifts |

FAQs

What does bullish mean in the stock market?

In stock trading, a bullish market is a market characterized by a sustained increase in stock prices. This may apply to individual stocks, an asset class, or the entire market. In bullish markets, investors are optimistic, so they buy more than they sell.

What is a bear market?

A bear market is in decline, which means prices are continually falling. This results in a downtrend where investors are pessimistic, so they sell more than they buy.

How do bullish and bearish trends affect investments?

In a bullish market, investors try to buy when the price is still low and sell when it is high. To invest in such markets, you need to identify uptrends and enter long positions. The opposite happens in bear markets where investors look to exit their current positions to avoid losses.

What is the difference between a bull and bear market?

The main difference between a bull and bear market is in the direction of the price movement. When the price movement is positive and stock prices are rising, then the market is said to be bullish. Conversely, a bearish market is characterized by continuously dropping prices.

How can I identify a bullish market trend?

A bullish market trend is characterized by higher highs and higher lows. There’s also an increase in trading volumes as more people look to buy instead of selling. You may also use technical tools like moving averages to identify bullish trends.

What does it mean to be bearish on a stock?

To be bearish on a stock means you’re not confident about the outlook of the stock’s price in the future. This means you expect the price of the stock to drop below its current position in the near future.