Everything a trader does in Forex trading is summed up by one thing – trying to predict potential price movement using different clues. One of such clues is order block trading. This strategy involves trying to identify specific areas on a trading chart where big players in the market (also known as institutional traders) have placed a significant number of buy and sell orders.

These order clusters can have significant impacts on market sentiment, liquidity, and price movement, which can give you insights on how to place your next trade. In this piece, we look at order blocks in trading, how to find them on charts, and how to use them in your trades.

What is an Order Block in Trading?

Let’s begin with definitions, what is an order block in trading and how does it work?

Order blocks zones on a trading chart where big players (Like banks and other institutional investors) have placed a lot of buy or sell orders. These institutional investors often split large orders into smaller ones so they don’t affect the market adversely. These smaller trades happen over time as opposite orders build up. This strategy allows them to fill large orders without causing a sharp price change.

Since such order blocks tend to attract significant price action, investors trading price action can watch out for them as indicators of potential support or resistance levels on the price chart. It is also possible to use order blocks as a way of gaining insights into current market trends in order to identify trading opportunities.

To use order blocks in trading, you need to identify areas characterized by significant buying and selling interests. You can then use this to make decisions about when you need to enter or exit trades.

How Order Blocks Impact the Forex Market

Clusters formed by order blocks at specific price levels can influence price movement in a trading market in different ways. With forex blocks, there’s a large concentration of orders waiting on their turn to be executed. As a result, this area acts as a turning point where the direction of price movement can be changed.

The large number of buy or sell orders concentrated at this price level creates a strong support and resistance zone on the chart. As price approaches these levels, the large orders that are concentrated there will absorb the buying or selling pressure depending on the nature of the order. This can cause prices to either reverse or consolidate as the case may be.

Apart from their impact on pricing, an order block in forex can also affect liquidity as they’re often big enough to absorb all the available liquidity in the market, resulting in a temporary imbalance in demand and supply. It can also be used to determine the market sentiment since it shows the sentiment of large market players who often have access to better information compared to other traders.

Identifying Order Blocks: Tips and Examples

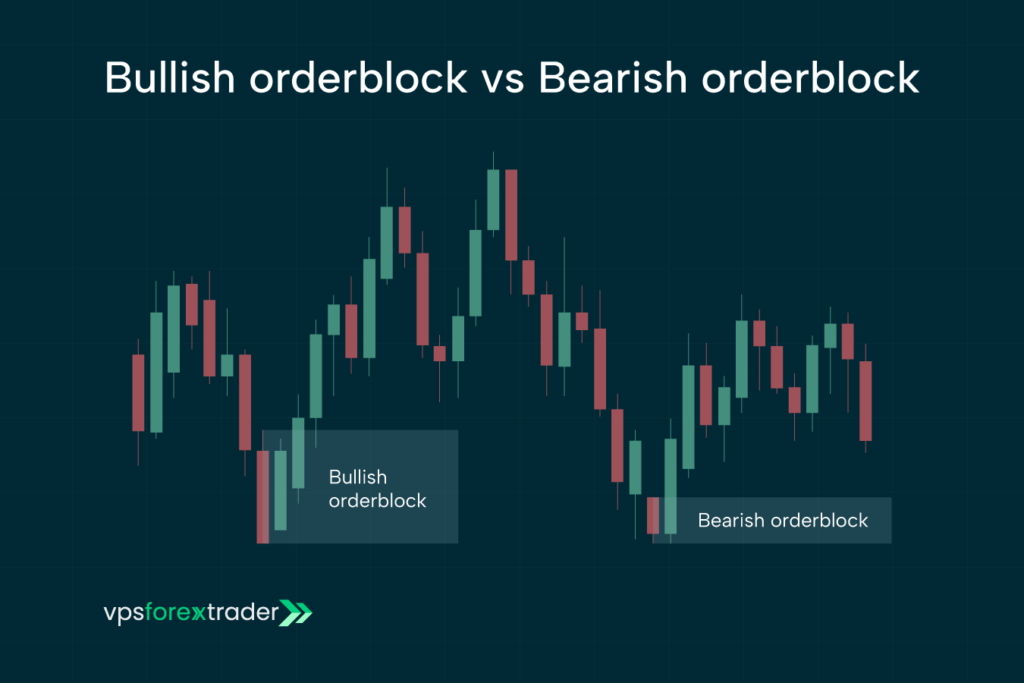

To spot an order block, you must carefully study charts. On the chart, it looks like a zone where price flips because big buyers or sellers step in. On the chart, an order block looks like a range in which price reverses due to the buying or selling pressure of institutional investors. Then price returns to the zone and finally exits it, changing its original direction.

Generally, you should look out for an engulfing pattern on the chart to spot an orderblock, then observe how the price behaves, relative to this range. This is a candlestick pattern that shows a market reversal. This type of pattern is created by two candles where the second candle is larger than the first and covers it.

Some tips for identifying order blocks are listed below:

- Look out for areas on the chart where the price is consistently reversing or stalling. This suggests a strong support or resistance level.

- Use indicators such as RSI or MACD to detect overbought or oversold conditions. This could signal a reversal near critical levels.

- Monitor trading volumes. This allows you to determine the intensity of buying or selling at a specific price point.

- Look out for areas where there’s price consolidation or ranging. This indicates areas where the market is starting to gather momentum for a potential breakout.

- Look out for broader market trends and key support/resistance levels. This can help identify potential areas of orderblocks formations.

Using Order Blocks in Forex Strategies

Now that you know what is order block in trading, how do you make use of this strategy? Generally, traders use order blocks to find strong support or resistance areas on a chart. These serve as great points to enter or exit trades depending on the nature of the market. The following are important order block forex strategies that you should know:

- Identify order blocks: the first step in trading with order blocks is identifying them. To do this, traders typically look out for price zones that show significant buying or selling activities. These zones indicate clusters of orders from institutional investors.

- Confirmation: the next step is to confirm the identified order block. This involves waiting for the price to return to this level and looking out for confirmation signals including strong reversal patterns or price movement.

- Enter a trade: if the block order is confirmed, traders can proceed to enter a trade in the projected direction of the price movement. For instance, if the order block is a support level, then the trader might buy with the hope of rising prices.

- Risk Management: There’s a need to manage risks when trading with order blocks. Traders need to set stop loss levels below the order block when entering long positions or above it for short positions. Take-profit levels should also be set based on the projected price movement.

Common Mistakes When Trading Order Blocks

Order block trading is a potentially powerful trading tool. Still, it needs skill and care to spot, check, and trade them well. Common errors to avoid include:

- Using only order blocks: To get the best results, pair order blocks with other tools like RSI, moving averages, or MACD.

- Inaccurate identification: It’s not enough to know what are order blocks, you also need to learn how to study charts and practice how to identify order blocks accurately.

- Ignoring the broader market context: In trading, the big market picture matters most. Look at trends, news, and economic facts to make better choices. Going against the main market trend makes trades riskier.

- Entering too early: Before entering a trade with order blocks, wait for the price to return to the order block level, as jumping in too early can lead to you trading based on false signals.

- Overleveraging: Do not risk too much of your capital on a single trade no matter how confident you are in the signal.

FAQs About Order Blocks in Trading

What is an order block in trading?

What is a order block in trading? An order block is a point on a trading chart that indicates zones where big traders place many buy or sell orders. It can act as a support or resistance level and help predict price changes.

How do order blocks work in the Forex market?

In the forex market, groups of orders or order blocks can change how prices move, affect liquidity, and sway market feelings. Because of this, they help spot price turns and find places to start or end trades.

What is the difference between order blocks and support/resistance levels?

To differentiate between these concepts, let’s define what is order block in forex. An order block is a point on a chart where big traders put many buy or sell orders. It can act as a support or resistance level and help predict price changes. Support/resistance levels on the other hand are areas where price bounced back and forth. An order block can be used to identify support and resistance levels, but they’re not the same.

How can I identify an order block?

On a chart, an order block is seen when a few candlesticks show an engulfing pattern. The price should break out of this range, then return within the range and rebound to mark the start of a new trend.

Are order blocks a reliable trading strategy?

Trading with forex order blocks is a great strategy as these blocks offer valuable insights into market dynamics. However, like every other technical tool, order blocks are not infallible. It is best to combine them with other indicators and implement risk-management measures to prevent losses.

What are the best tools for order block trading?

To use a block trading strategy, RSI or MACD can be used to detect overbought or oversold conditions. Volume indicators are also useful for identifying spikes in trading activities. Tools like Fibonacci retracement levels and support/resistance lines can be used to pinpoint order block zones.

How does order block trading compare to other technical strategies?

Order block trading focuses on the activities of institutional investors and their potential impact on market movement. This makes it different from other trend-following tools that focus primarily on price action. This strategy places a strong emphasis on demand and supply, with traders entering trades by anticipating price reversals caused by high supply or demand. Order block analysis is quite flexible and it can be applied across various timeframes and markets. This makes it a more adaptable strategy compared to other tools.