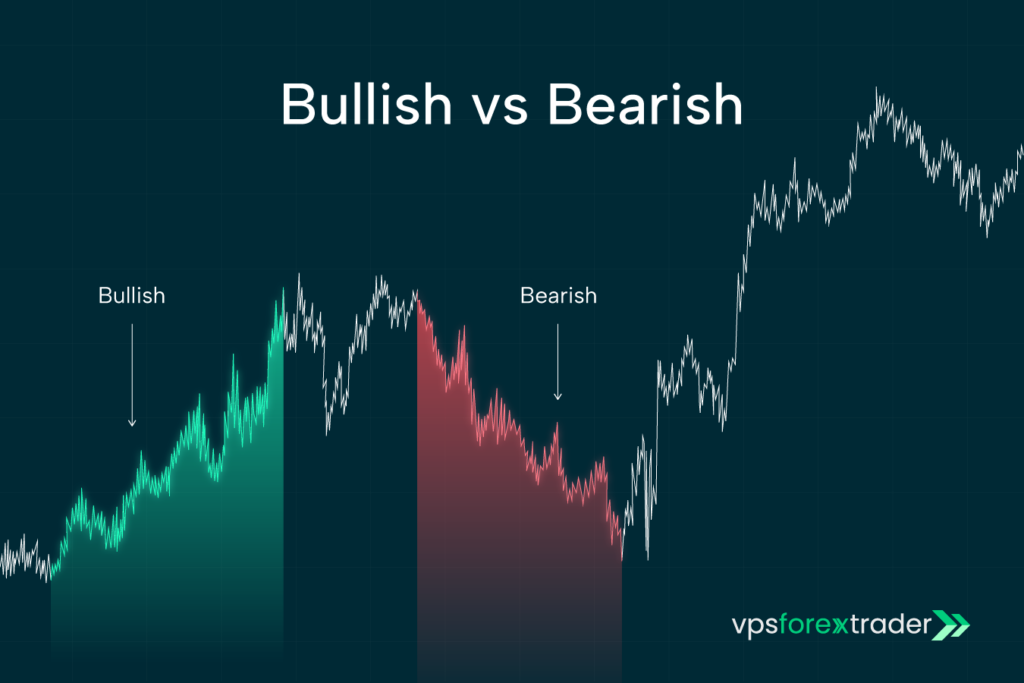

Financial markets are driven by sentiments. These can be positive or negative sentiments, giving rise to the concept of bullish and bearish markets. These terms define the overall expectations of investors and they drive both short-term price movements and long-term trends in the financial market.

In this post we will define what is bullish and bearish, highlighting the differences between these two market sentiments. We’ll also do a detailed bullish vs bearish comparison to understand the key differences between them.

What is a Bull Market? Explained

Before diving into a comparison between bull market vs bear market, let’s begin by defining some terms beginning with a bullish meaning. What is a bullish market and how is it different from a bearish market?

A bull market or bullish market refers to market conditions characterized by rising prices and generally favorable conditions. This market condition leads to a positive or optimistic outlook where investors expect the price of assets to rise. In a bullish market, investors can earn profit by buying and holding assets or taking long positions.

Understanding Bearish Trends in the Market

Next, to further understand the difference between bear vs bull market, let’s explore bearish meaning. A market is described as bearish when it is in decline. This is characterized by a continuous drop in asset prices, leading to a pessimistic outlook for investors. In a bearish market, investors sell assets or take defensive positions instead of buying.

Bull vs Bear Market: Key Differences

When you take a closer look at a bear vs bull market, the key difference as you will discover is in their price trend. Knowing what is the difference between a bull and a bear market will also influence your investment strategy and behavior. Here are some of the key differences between these two market conditions:

- Price trend: as explained above, prices are on the rise in the bull market. On the flip side, prices are in a declining trend in the bear market.

- Demand and supply: the bull market is characterized by a combination of strong demand and weak supply of securities. This means many investors are interested in buying, while only a few are willing to sell, resulting in a price rise as investors compete to obtain assets. The opposite happens in a bearish market. Investors are pessimistic, which means more people will be looking to sell, while only a few are interested in buying, causing prices to drop.

- Investment strategy: in a bullish market, the best strategy is to simply focus on growth stocks and long-term investment options. On the other hand, investors in a bear market tend to focus on defensive stocks and short-term trading strategies since bearish market conditions are often short-lived.

What Does Bullish Mean in Stock Market Investments?

So what does bullish mean from a stock market investment perspective? In stock market investments, a bullish outlook means prices of stocks are expected to rise over a certain period of time. This bullish market meaning can be applied to specific market indexes, an industry, individual stocks, or an entire asset class depending on the context of the conversation.

To help investors fully understand what does bullish mean in stocks, it is typically defined as a market condition where the prices of stocks rise by up to 20% or more after a recent low.

How to Identify Bullish and Bearish Market Trends

Now that you are familiar with bullish vs bearish meaning, how do you identify each of them? Generally, bullish and bearish markets have unique indicators that investors can use to identify them when studying market trends.

On financial market charts, a bullish market shows an uptrend in the price of the stock or index being considered. This is characterized by the price making higher highs and higher lows. On the flip side, bearish markets show lower highs and lower lows, indicating that the price is in a downtrend.

Investors can also use technical indicators such as moving averages and relative strength index to identify potential market trends. Analyzing trading volumes and chart patterns can also help you identify trends and potential reversals in a bullish vs bearish market.

Bullish vs Bearish: Impact on Stock Market Strategy

Expectedly there are different investing strategies for bull and bear markets. So how do you trade bearish vs bullish stock? First, you need to know the difference between bull vs bear markets and their impact on trading strategy.

The basic strategy in bullish markets is to buy low and sell high. Thus, it is best to target currency pairs with strong upward momentum and good economic indicators. Confirm the uptrend by using technical analysis tools such as moving averages and trendless. Then you can look for the right moment and enter long positions as you ride the upward wave. Don’t forget to protect your gains from unexpected market reversals by setting stop-loss orders.

When the market is bearish, investors naturally adopt a defensive strategy. The trick is to sell or short-sell currency pairs in order to profit from the downward price movements. Note that the chances of ending up with a loss is greater in bearish markets because stock prices are continually falling. While some investors buy instead of selling in anticipation of an upturn, this is a long-term strategy and you may take some losses before any turnaround occurs.

FAQs

What does bullish mean in the stock market?

In stock trading, a bullish market is a market characterized by a sustained increase in stock prices. This may apply to individual stocks, an asset class, or the entire market. In bullish markets, investors are optimistic, so they buy more than they sell.

What is a bear market?

A bear market is in decline, which means prices are continually falling. This results in a downtrend where investors are pessimistic, so they sell more than they buy.

How do bullish and bearish trends affect investments?

In a bullish market, investors try to buy when the price is still low and sell when it is high. To invest in such markets, you need to identify uptrends and enter long positions. The opposite happens in bear markets where investors look to exit their current positions to avoid losses.

What is the difference between a bull and bear market?

The main difference between a bull and bear market is in the direction of the price movement. When the price movement is positive and stock prices are rising, then the market is said to be bullish. Conversely, a bearish market is characterized by continuously dropping prices.

How can I identify a bullish market trend?

A bullish market trend is characterized by higher highs and higher lows. There’s also an increase in trading volumes as more people look to buy instead of selling. You may also use technical tools like moving averages to identify bullish trends.

What does it mean to be bearish on a stock?

To be bearish on a stock means you’re not confident about the outlook of the stock’s price in the future. This means you expect the price of the stock to drop below its current position in the near future.